Foundations in Personal Finance is not your average homeschool course. Seriously. It’ll transform how your teens think about money.

Buy today, and start anytime in the next year.

Foundations in Personal Finance is not your average homeschool course. Seriously. It’ll transform how your teens think about money.

Buy today, and start anytime in the next year.

Bonus Course!

The hit documentary about the dark side of the student loan industry, included with your purchase.

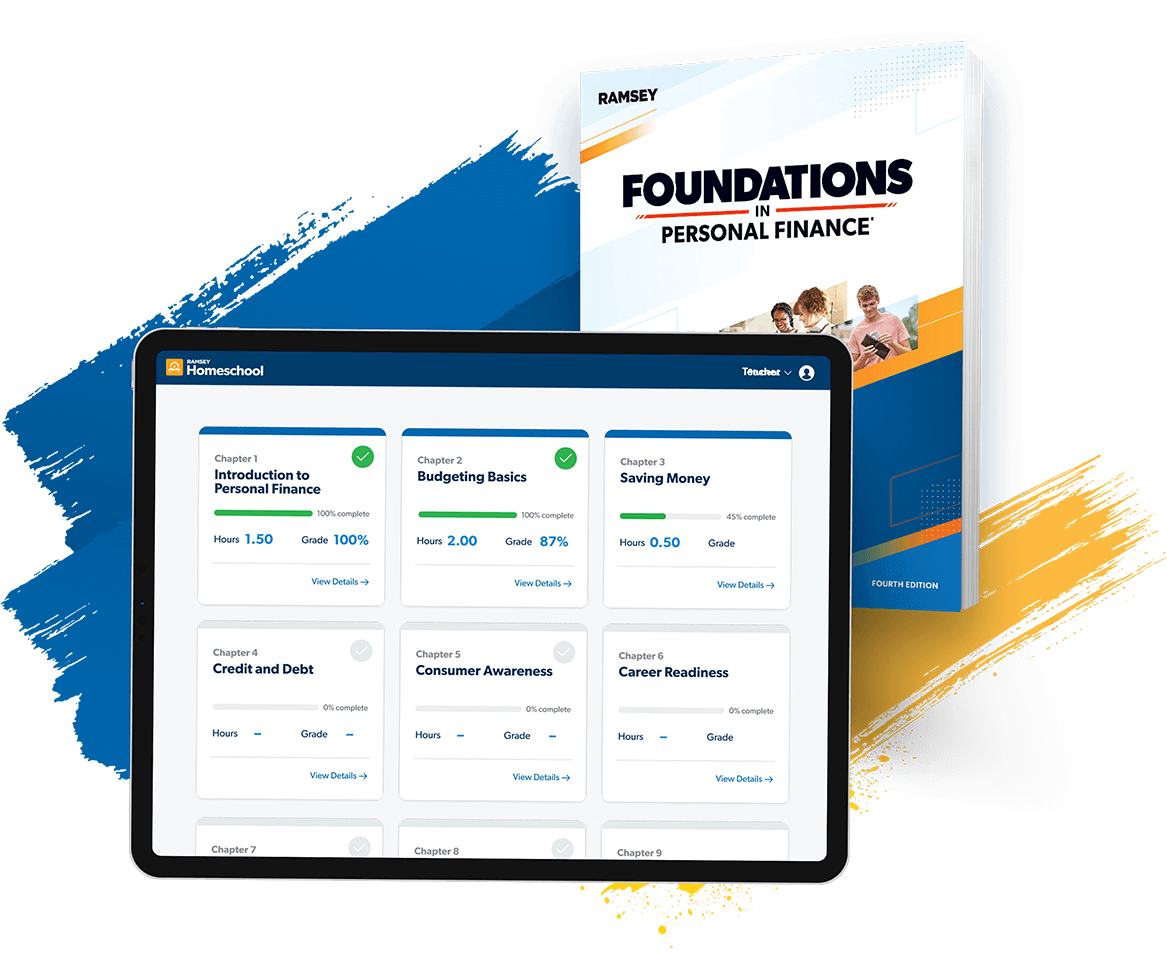

Built for How You Homeschool

Whether you want to start with Chapter 1 or Chapter 6, learn on-the-go or in your own space, we’ve got you covered with a curriculum that works for your family.

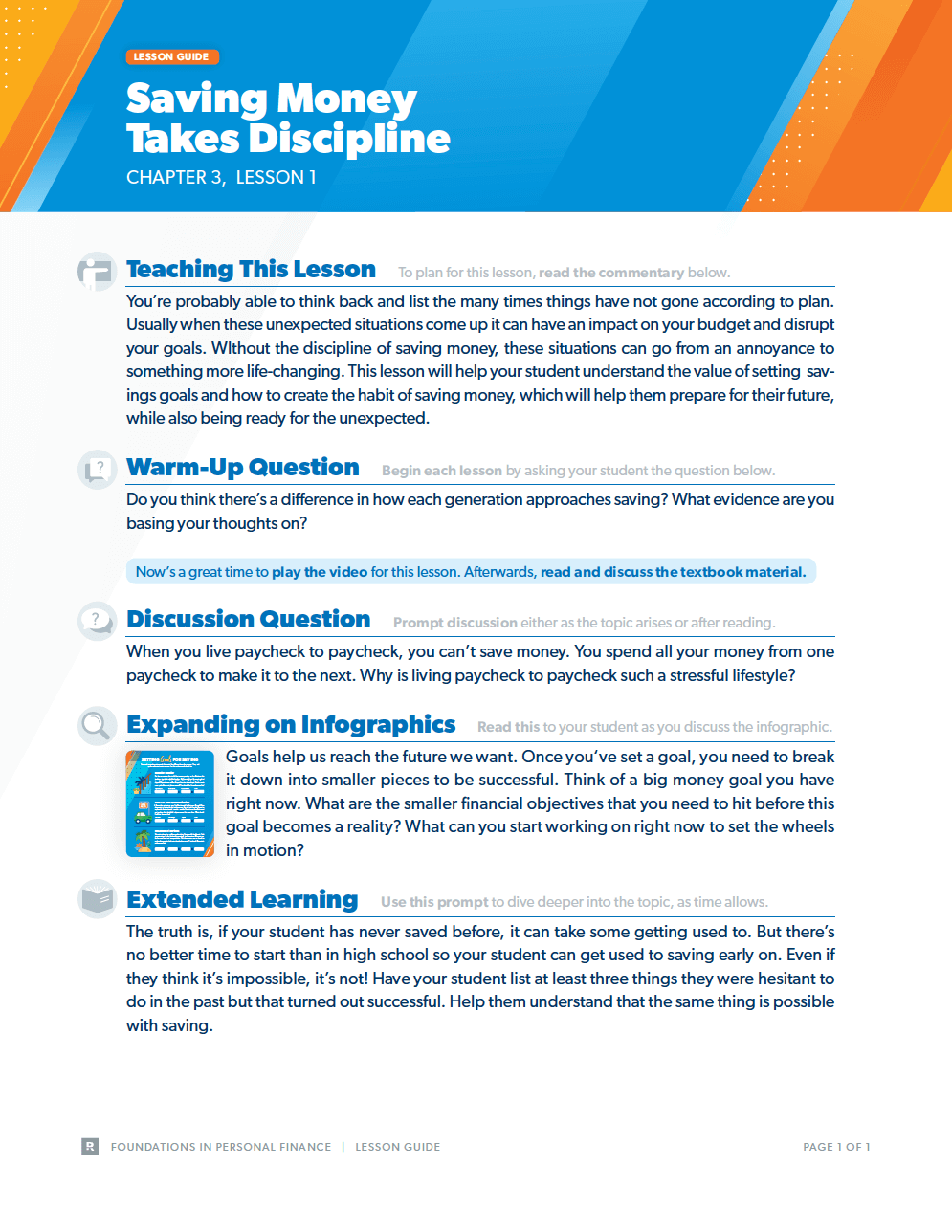

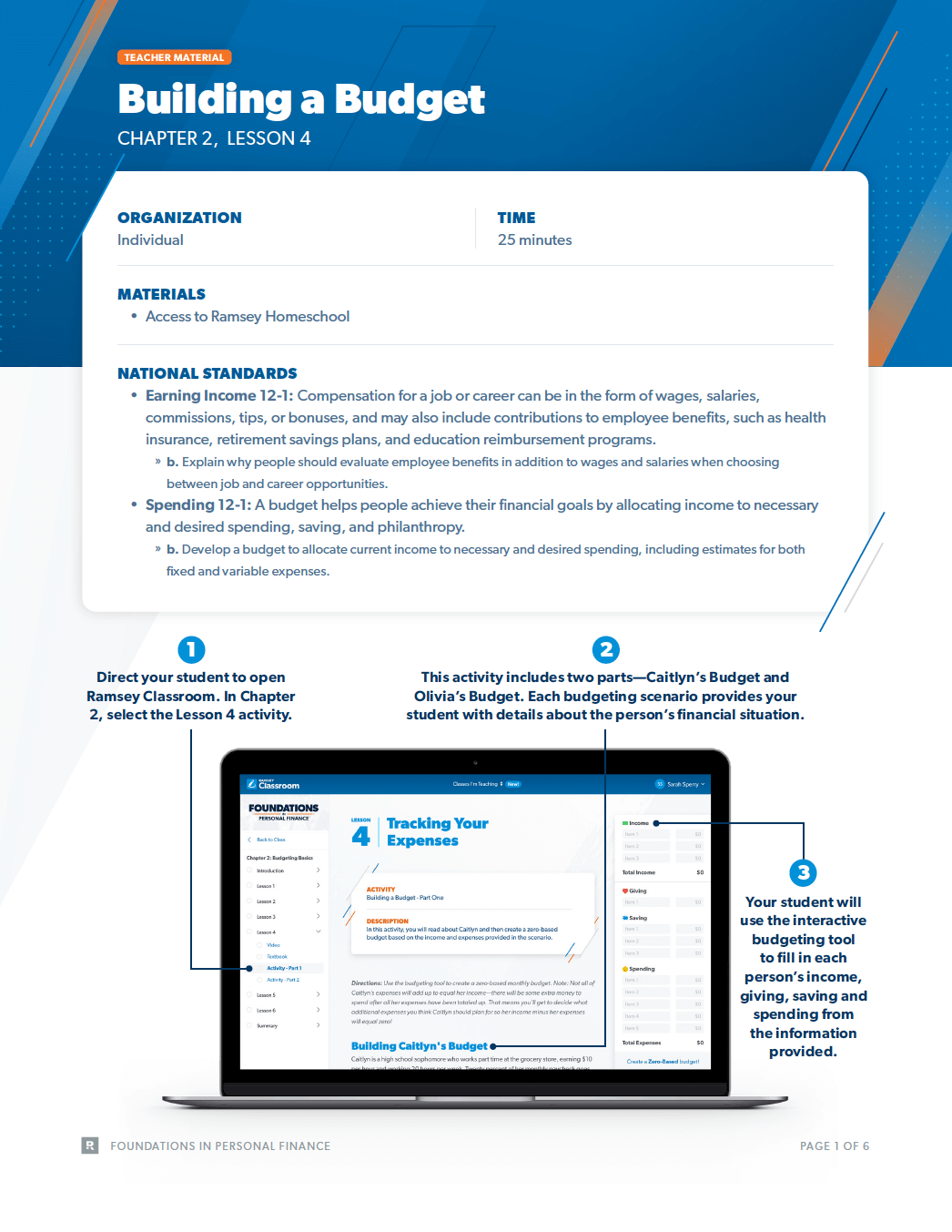

Everything You Need to Teach Confidently

Don’t sweat trying to explain a 401(k) or compound interest. We’ve got your back.

Save Valuable Time

We’ve done the planning and prep work for you—so you can teach stress-free.

Built for How You Homeschool

Whether you want to start with Chapter 1 or Chapter 6, learn on-the-go or in your own space, we’ve got you covered with a curriculum that works for your family.

Everything You Need to Teach Confidently

Don’t sweat trying to explain a 401(k) or compound interest. We’ve got your back.

Save Valuable Time

We’ve done the planning and prep work for you—so you can teach stress-free.

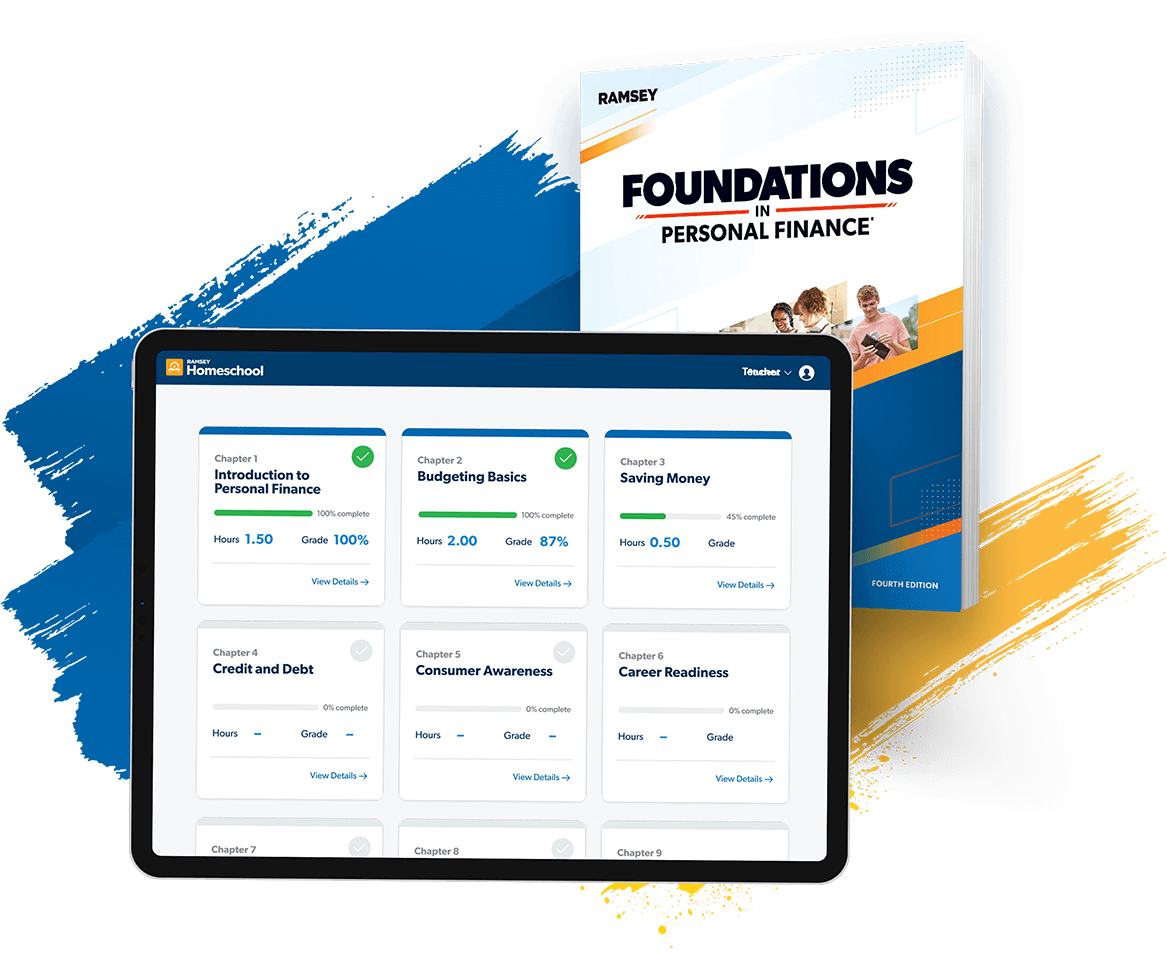

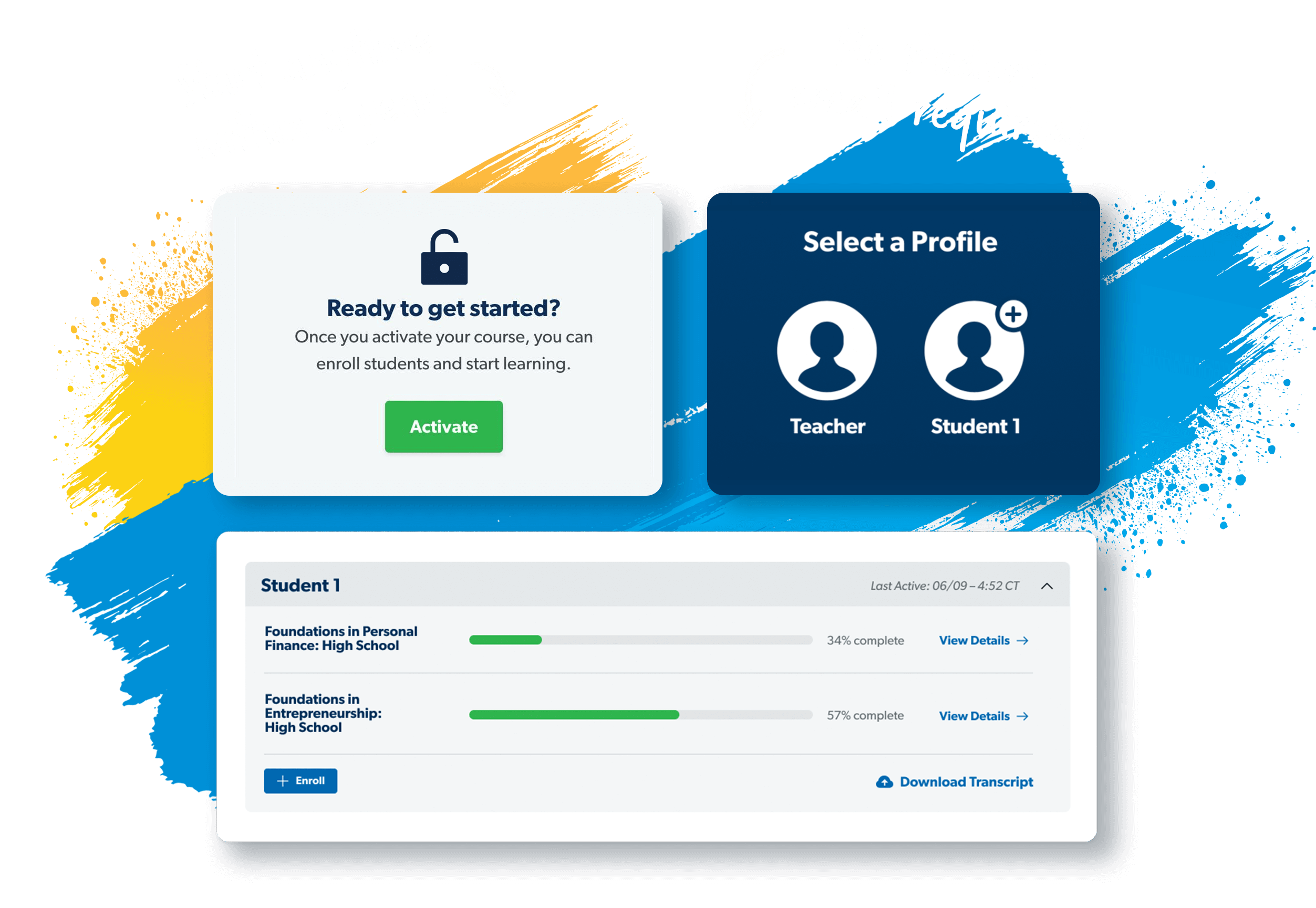

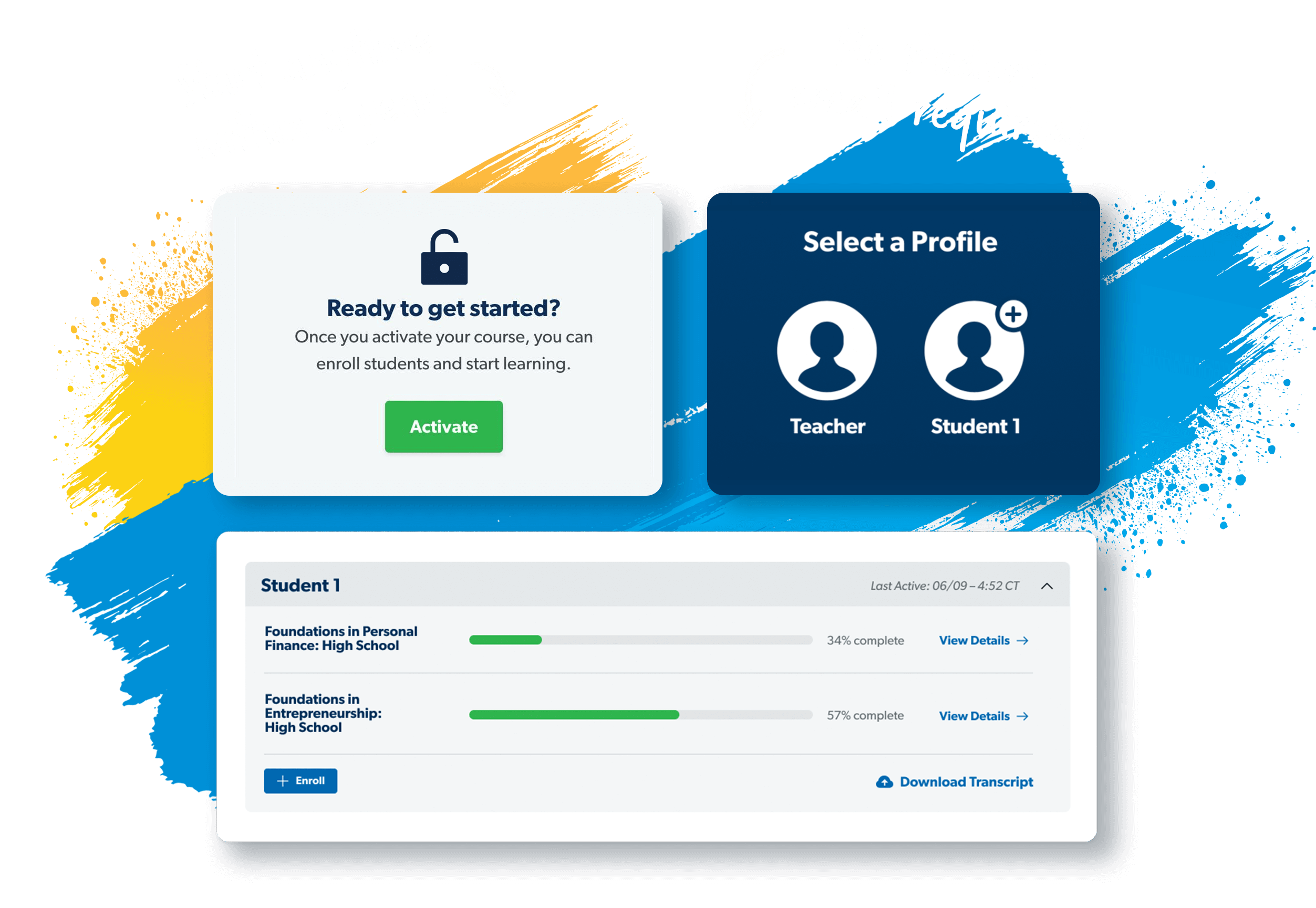

You're in the driver's seat.

Ramsey Homeschool makes it easy to set up profiles, enroll students, and monitor their progress.

TABLE OF CONTENTS

STANDARDS CORRELATIONS

FAQs

Table of Contents

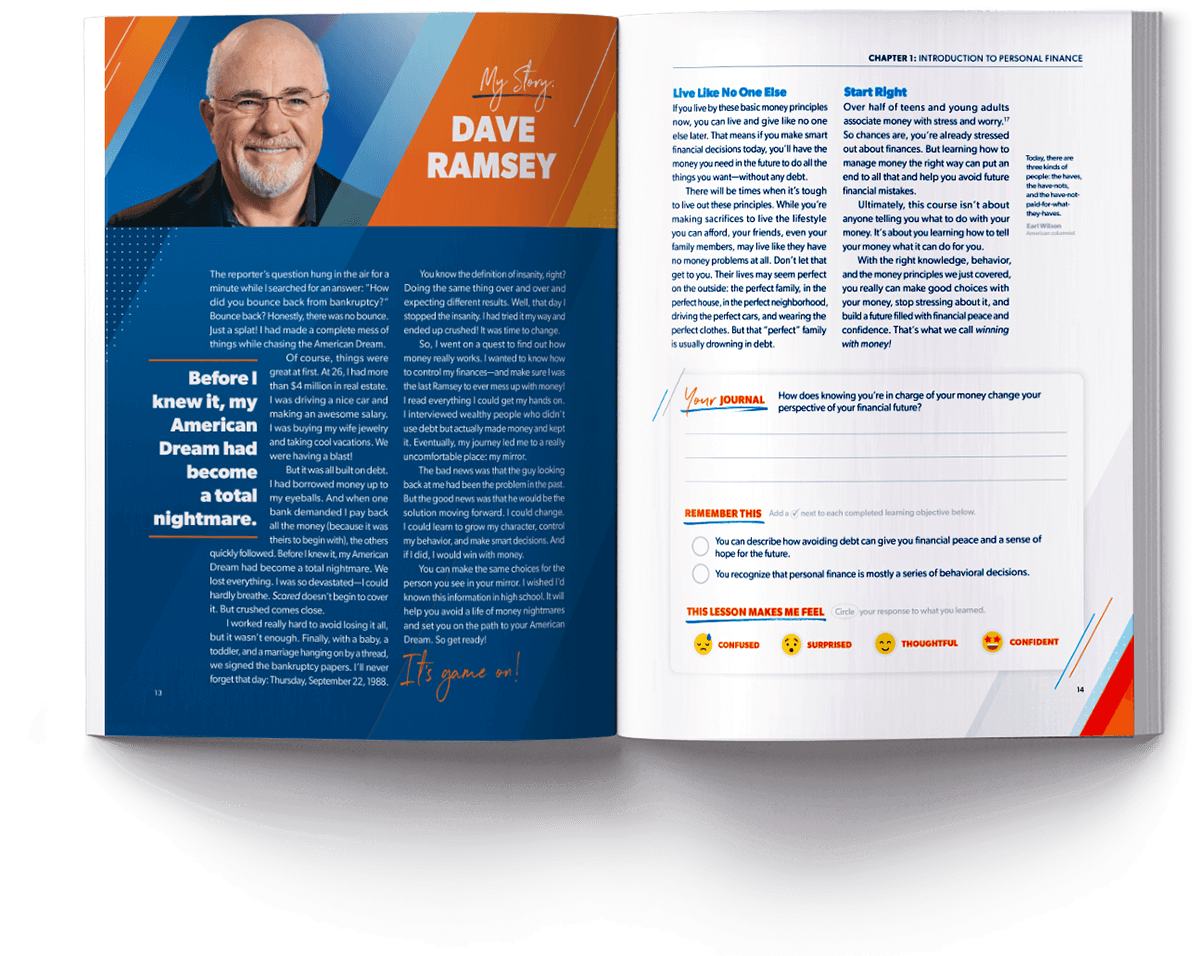

The Foundations in Personal Finance high school curriculum consists of 13 chapters of essential personal finance principles like how to budget, save, avoid debt, invest, be a wise consumer and much more!

Chapter 1: Introduction to Personal Finance

Chapter 2: Budgeting Basics

Chapter 3: Saving Money

Chapter 4: Credit and Debt

Chapter 5: Consumer Awareness

Chapter 6: Career Readiness

Chapter 7: College Planning

Chapter 8: Financial Services

Chapter 9: The Role of Insurance

Chapter 10: Income and Taxes

Chapter 11: Housing and Real Estate

Chapter 12: Investing and Retirement

Chapter 13: Global Economics

Let's find the right curriculum for you.

We look forward to connecting with you soon!

State and National

Standards Correlations

The Foundations in Personal Finance curriculum meets or exceeds standards in all 50 states. The curriculum also meets all national standards for personal finance.

National Jump$tart

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

Frequently Asked Questions

You asked—we answered. Here are some of our most frequently asked questions about Foundations in Personal Finance: Homeschool Edition for High School.

Does the digital curriculum come with a physical student textbook?

Yes. The course is offered in two formats: Print + Streaming or as a Fully-Digital course. The Print + Streaming format will ship a physical textbook with a unique voucher code that allows for 1-year access to stream videos. The Fully-Digital format includes a digital version of the textbook integrated with the streaming videos.

What age level is the Foundations in Personal Finance high school curriculum meant for?

This curriculum is designed for high school students grades 9–12.

How long does it take to teach Foundations in Personal Finance?

The Foundations in Personal Finance high school curriculum includes 13 comprehensive chapters, and each chapter can stand on its own. So, it’s up to you! You can either use the curriculum as a semester-long course or teach the chapters individually.

Can my teen get credit for this course?

While credits are not directly provided by Ramsey, you will have access to downloadable your students' gradebook transcripts from within the app. Transcript can be provided to your student’s umbrella school or governing agency to receive credits.

How long will I have access to the course?

Each course comes with 1-year access beginning at the time you redeem your voucher code.

Can I purchase the digital curriculum for a

homeschool co-op?

Yes! Groups larger than 10 students can be purchased for a discount by speaking with our team at 800.781.8914 or by emailing help@ramseyeducation.com.

Do I need to download an app for my phone?

No—Ramsey Homeschool is a mobile-friendly web application you and your students can access anytime, anywhere, and from any device.