Red Cliff Homes

Construction | Las Cruces, New Mexico

Schools Sponsored: 3

Sponsor Since 2020

Remember what it felt like when you didn't know how money worked? Well, millions of high school students graduate every year without learning basic money skills and end up living paycheck to paycheck.

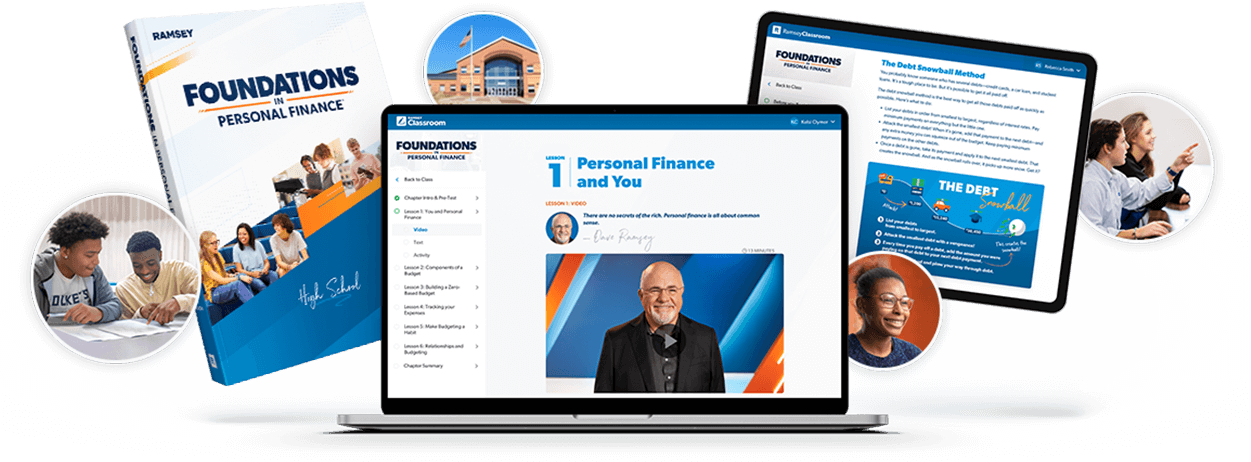

We created the Foundations in Personal Finance curriculum so students can learn the right way to handle money before they graduate. By sponsoring a school, you’ll get our Foundations in Personal Finance curriculum in the hands of teachers in your community—and help prevent students from making the same money mistakes we all made.

STEP 1

STEP 2

STEP 3

STEP 4

A Sponsorship Advisor will be in touch soon to help you identify your school(s) and give you a custom quote.

Legal mumbo jumbo is no one’s cup of tea, but this is important stuff. By submitting this form, you agree that Ramsey Solutions and its agents and affiliates may contact you via email, telephone, or text messages, as well as may be permitted under our Privacy Policy and Terms of Use. This may include up to eight advertising messages per month via autodialer, artificial voice, and/or prerecorded messages.

Need a break from texts? Reply STOP from the mobile device receiving the messages at any time. (It’s not you, it’s us. Really.) Opting out may mean missing out on cool Ramsey product updates but the good news is that our products and services are available even without submitting this form. Messaging and data rates apply.

Red Cliff Homes

Construction | Las Cruces, New Mexico

Schools Sponsored: 3

Sponsor Since 2020

United Arkansas Federal Credit Union

Credit Union/Banking | Little Rock, Arkansas

Schools Sponsored: 4

Sponsor Since 2020

Cape Metal Recyclers

Manufacturing | Cape Girardeau, Missouri

Schools Sponsored: 2

Sponsor Since 2019

Edsouth

Nonprofit | Franklin, TN

Schools Sponsored: 153

Sponsor Since 2016

Austin Automotive

Auto/Service | Canon City, Colorado

Schools Sponsored: 2

Sponsor Since 2019

Green Financial Services

Financial Services | Duluth, Georgia

Schools Sponsored: 3

Sponsor Since 2017

The Army National Guard

Government/Military | Arlington, Virginia

Schools Sponsored: 340

Sponsor Since 2020

Bespoke Plastic Surgery

Plastic Surgery | Charlotte, North Carolina

Schools Sponsored: 2

Sponsor Since 2022

Red Cliff Homes

Construction | Las Cruces, New Mexico

Schools Sponsored: 3

Sponsor Since 2020

DW Distribution

Construction | Desoto, Texas

Proudly Sponsors

Desoto High School

Sponsor Since 2018

Cape Metal Recyclers

Manufacturing | Cape Girardeau, Missouri

Schools Sponsored: 2

Sponsor Since 2019

Edsouth

Nonprofit | Franklin, TN

Schools Sponsored: 153

Sponsor Since 2016

Austin Automotive

Auto/Service | Canon City, Colorado

Schools Sponsored: 2

Sponsor Since 2019

Green Financial Resources

Financial Services | Duluth, Georgia

Proudly Sponsors Crews Middle School

Sponsor Since 2017

The Army National Guard

Government/Military | Arlington, Virginia

Schools Sponsored: 340

Sponsor Since 2020

Bespoke Plastic Surgery

Plastic Surgery | Charlotte, North Carolina

Schools Sponsored: 2

Sponsor Since 2022

Take a peek inside to see what students will learn!

Nope! We’ll handle the school onboarding process. Your sponsorship dollars will cover the cost of the Foundations curriculum as well as the training and tools needed to equip a teacher at that school to teach.

Your Sponsorship Advisor will give you a customized list of available high schools.

Yes! Your business logo or name will be visible on our digital curriculum and will remain there for as long as your sponsorship is in place.

While your Ramsey Education sponsorship is not a charitable donation, you can write off the sponsorship as a marketing expense.

Yes, we will introduce you to the school and establish your relationship with them. Then you can connect with the teacher.

The Foundations in Personal Finance high school curriculum has 13 chapters. Click below to see each chapter’s contents.