Listen to this article

What Is the Difference Between Term vs. Whole Life Insurance?

What Is Term Life Insurance?

What Is Whole Life Insurance?

Cost Comparison: Term vs. Whole Life Insurance

Don’t Wait Until You Need Life Insurance to Get It

Frequently Asked Questions

If anyone in your life depends on your income, you need life insurance. But not any old life insurance—the right life insurance. Let’s talk about term life vs. whole life.

Life insurance may not be a fun topic, but it matters! Your two main options are term life and whole life. But which is better? The first is a safe plan to protect your family—the second is a rip-off. We’ll walk you through the differences in term life vs. whole life so you can see what we mean.

What Is the Difference Between Term vs. Whole Life Insurance?

We’ll give it to you straight—term life insurance works, while whole life fails. The reason is simple: The true purpose of life insurance is to replace your income if you die, and to do it as cheaply as possible. And that’s exactly what term life does. But whole life? It’s costly and confusing because it puts investing into the mix with insurance. It adds up to an expensive mess, which we’ll discuss in detail below.

For now, here’s the nutshell difference. Term life has a set premium that remains the same throughout the life of the policy, and it only lasts for a defined number of years. Whole life premiums can vary (a lot), last your whole life even after you’re past the age when you’d need a death benefit for dependents, and are over-complicated by bad investment options.

Frankly, a life insurance policy isn’t a money-making scheme. It’s there to provide peace of mind for your family should the unthinkable happen. Period. And that’s exactly the way term life works: It’s simple, affordable and reliable. Think of term life as the family bulldog—you hope you’ll never need him to do his thing, but you’re sure as heck happy to have him around the house.

Of course, we know you’re probably interested in building wealth and protecting your family along the way. And those are both legit goals! But each requires its own tool for the job, and you’ll see much better results with both if you keep them separate.

Bottom line: Don’t mix insurance with investing. You’ve got way better ways to invest than what you’ll find in an insurance plan. Which sounds like more fun to you—investing in growth stock mutual funds so you can enjoy your retirement or “investing” in a plan that’s based on whether you kick the bucket? Easy answer!

Now let’s look closer at term life vs. whole life.

Compare Term Life Insurance Quotes

Monthly Estimate

0 - 0

What Is Term Life Insurance?

Term life insurance provides you life insurance coverage for a specific amount of time. (Hence the term term.) If you get a 20-year policy, you’re covered for that 20-year term.

If you die at any point during those 20 years, your beneficiaries (the people you picked to receive the death benefit of your policy) receive a life insurance payout. For example, if you bought a $300,000 policy for a 20-year term and you die within the next 20 years, your beneficiaries would get $300,000. Yes, it’s really that simple.

And here’s the key difference between whole life vs. term life: Term life plans are much more affordable than whole life insurance. This is because the term life policy has no cash value unless you die during the course of the term (we’ll talk more about that in the whole life section).

But that’s not to say term life is a waste! After all, you wouldn’t skip out on homeowners insurance just because you’d never personally met anyone who’d lost their home in a fire. You’re willing to pay a small price for the coverage to protect yourself from the unthinkable (but totally possible) event. Term life’s the same. You want it because life is precious, hard things happen, and you care about your family. And despite what you’ll hear from whole life salesmen, life insurance has just one job: to replace an income. (That’s one big reason we like it.)

Term Life Pros and Cons

Sometimes term life gets hate from whole life marketers because term doesn’t let you build cash value. They’re wrong of course—but we get why cash value might sound like a smart idea. Just to spell out more of why we recommend term life all day long, here’s a summary of the pros and cons.

|

Pros |

Cons |

|

Is way more affordable than whole life. |

You will hear some smack about a lack of investment options, but this isn’t so much a con as it is a way to muddy the waters and sell you whole life. |

|

Gives you the option to invest however you prefer (instead of locking your cash into a very low-return investment). |

|

|

Allows you to move toward becoming self-insured (more on that below). |

Remember the only job life insurance has is to replace the policyholder’s income. From just about any angle, term life gets that job done better than whole life.

Of course, no one wants to use their term life insurance policy—but if something does happen, at least you know your family will be taken care of. They’ll still miss you, but they won’t miss you and wonder how they’re going to pay the bills.

Interested in learning more about life insurance?

Sign up to receive helpful guidance and tools.

What Is Whole Life Insurance?

Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life. Whole life plans are generally much more expensive than term life. There are a couple of reasons for that, but mostly it’s because you’re not just paying for insurance here.

Whole life insurance costs more because it’s designed to build cash value, which means it tries to double up as an investment account and life insurance. Blending insurance and a savings account into one product? That makes no sense! It’s like training your house cat to be a watchdog: She might learn how to scratch a few intruders, but she’ll never really guard your property, and she’ll be a miserable pet.

Here’s another truth about the difference between whole life and term life insurance. If you follow Ramsey’s 7 Baby Steps, you won’t need life insurance forever. Ultimately, you’ll be self-insured. Why? Because you’ll have zero debt, a full emergency fund and a hefty amount of money in your investments. Hallelujah!

Whole Life Cons and Pros

We don’t have a lot of positive things to say about whole life insurance. And for very good reason! It’s one of the worst financial products on the market, it’s confusing, and it’s a budget-buster to boot. But we’ll just add this chart to make the problems crystal clear.

|

Cons |

Pros |

|

Is far more expensive than term life. |

The only one we’ve discovered: whole life is better than no life insurance at all! |

|

Tries to do two financial jobs (insurance and investing) at once but ends up doing neither well. |

Hunting for good things about whole life could become a new hobby? |

|

Delays or stops you from ever becoming self-insured. |

Trying to think of whole life benefits could help you build patience . . . |

|

You (and your family) can lose a ton of your cash value if you die without cashing it out. |

. . . still waiting . . . |

The moral of the story is this: Keep your insurance and your investments separate. You don’t want to spend years investing your hard-earned money only to leave it all to your insurance company. Be smart. Get term life insurance.

Cost Comparison: Term vs. Whole Life Insurance

Monthly Cost by Age

| Term Life | Whole Life | Savings |

|---|---|---|

| $12.18 | $142.12 | $129.94 |

| Term Life | $12.18 |

| Whole Life | $142.12 |

| Savings | $129.94 |

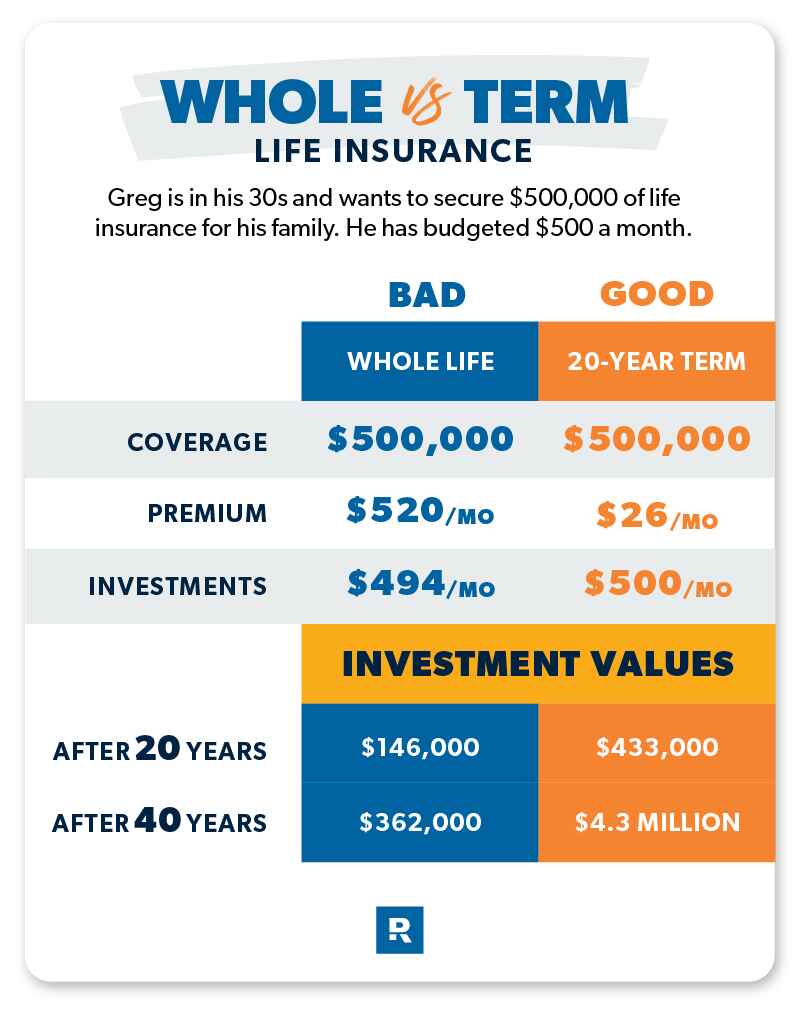

Let’s say we have a friend named Greg who’s in his 30s and wants to get $250,000 of life insurance for his family. He meets with a whole life insurance agent who pitches a $260-per-month policy that will include the insurance coverage and build up savings for retirement (which is what a cash value policy is supposed to do).

On the other hand, a term life agent tells Greg he can get a 20-year term with $250,000 of coverage for about $13 per month—that’s a $247 difference compared to whole life.

If Greg goes with the whole life, cash value option, he’ll pay a hefty monthly insurance premium. But it’s because the part of his premium that isn’t insuring him is going toward his cash value “investment,” right? Well, you’d think, but then come the fees and expenses . . .

In truth, the additional $247 per month disappears into commissions and expenses for the first three years. After that, the cash value portion will offer a horrifically low rate of return for his investments (we’re talking 1–3% here!).

But here’s the worst part. Let’s say Greg gets this $250,000 whole life policy at 30 years old. He pays $260 per month, with $15 going to the insurance and the rest into that savings account with a 2% return rate. After 40 years of paying way too much for his insurance, Greg is 70 and has $250,000 in insurance and roughly $180,000 in cash value. Then, Greg dies. How much does the insurance company pay out to his wife and kids? $250,000. But wait! What happened to the $180,000 of Greg’s hard-earned savings? The insurance company keeps it. Sound like a scam? That’s because it is!

You see, only Greg was entitled to the money in that savings account. So to keep it out of the insurance company’s pockets, he would have needed to withdraw and spend it while he was still alive. Talk about pressure! Unfortunately, Greg died before he had the chance to live it up. Now Greg is rolling in his grave and his insurance agent is staying in a five-star resort on Greg’s dime.

But what if Greg instead chose the $13, 20-year term life policy and decided to invest the $247 per month he’ll save by not choosing the whole life plan? If he invests in good growth stock mutual funds with an 11% average annual rate of return, he would have about $214,000 in investments by the time his 20-year term life policy expires and more than $2.1 million at age 70. That’s a lot of bang for your buck! We think Greg will rest much easier knowing his family will be staying at that five-star resort.

Don’t Wait Until You Need Life Insurance to Get It

Look, this death stuff isn’t easy to think about. But life is precious! We can’t see the future and aren’t promised tomorrow. The cost of not having a plan in place for the unthinkable is much higher than the cost of term life insurance. You need to keep your loved ones protected.

The ideal time to buy life insurance is when you’re young and have a clean bill of health, especially because life insurance companies look at the risks of the person purchasing the policy when underwriting it. If you’re in the market for new life insurance or want an expert to talk to, we recommend RamseyTrusted partner Zander Insurance. Don’t let another day go by without being protected. Start here to get your term life insurance quotes.

Term Life vs. Whole Life Insurance FAQs

-

Is term life better than whole life?

-

Yes, it is far better to get term life than whole life. We don’t want you to get ripped off, we do want to see your family well protected, and we for sure want your financial future to include wealth and the chance to become self-insured. The only kind of policy that lets you hit all those goals is term life. But whole life misses the mark in every department.

-

How much life insurance do I need?

-

That’s easy. You need policy coverage equal to 10 to 12 times your annual income. Say you’re making $50,000 a year. You need at least $500,000 in coverage. That replaces your salary for your family if something happens to you. You can run the numbers with our term life calculator. Quick note: Don’t forget to get term life insurance for both spouses, even if one of you stays at home with the kids. Why? Because if the stay-at-home parent was gone, replacing that childcare and home upkeep would be expensive! If you want to make sure your family is covered, take our 5-Minute Coverage Checkup.

-

How long do I need term life insurance?

-

We recommend a policy with a term that will see you through until your kids are heading off to college and living on their own. That’s anywhere from 15 to 20 years depending on your kids’ ages. Why so long? Well, a lot of life can happen in 20 years.

Let’s say you get term life insurance in your early 30s, when you and your spouse have an adorable 2-year-old toddler. You’re laser-focused on paying off all your debt (including the house), but you have an eye on retirement planning in the future. Fast-forward 20 years—you’re both in your 50s and that little pint-sized toddler is now a college grad. The years went by fast.

But look where you are! You’re debt-free—and with your 401(k), savings and mutual funds, you’re sitting at a cool net worth of $500,000 to $1.5 million! By working the plan, you built up your net worth and your peace of mind. Now if the unthinkable should happen, even without life insurance, the surviving spouse could live off your savings and investments. Congratulations, you’ve become self-insured! Your need for life insurance has shrunk or vanished by now.

-

What happens to term life insurance at the end of the term?

-

It’s nothing sensational. The policy will just expire, but you won’t notice. You’ll already be in the money.

-

What information do I need when getting a life insurance policy?

-

Applying for life insurance will mean providing some personal info, so let’s look at a few of the things you’ll need to answer as you look for coverage.

- Do you already have any existing life insurance?

- How’s your overall health?

- Any medical history of serious illness?

- What’s your household income?

- How much are your monthly expenses?

- How much debt do you have, including a mortgage?

- What plans have you made toward retirement?

- What are your plans to cover college for your children?

- Have you thought about how you want to pay for funeral expenses?

- What’s your strategy around estate planning and tax?

- Do you have a will, and does it include plans for a trust?

- What’s your age?

- The ages of your children?