As we kick off the new year, how are you feeling about your own financial situation and the economy as a whole? Are you feeling scared about a possible recession looming around the corner? Are you worried about rising prices at the pump and the grocery store? Are you afraid to take a quick peek at your 401(k) balance?

If that’s you, you’ve got plenty of company.

According to The State of Personal Finance, the vast majority of Americans (82%) are worried about the strength of the economy and almost half (46%) have lost sleep over the last few months worrying about their financial situation. Meanwhile, a lot of folks have fallen deeper into debt since the summer and about four in 10 Americans have no savings at all. America, we have a problem!

But if you’re investing to build wealth and save for retirement, what you can do is get the information you need to help you make empowered decisions and keep a level head—no matter what’s happening on Wall Street.

How Much Can You Save for Retirement in 2023?

According to The National Study of Millionaires, the path to becoming a millionaire runs through your 401(k)! That’s where eight in 10 millionaires built their wealth. And thanks to adjustments for inflation, you’ll be able to save a little more in your workplace retirement accounts this year.

- The IRS is raising the annual contribution limits for employer-sponsored retirement plans to $22,500 (up from $20,500 in 2022). This includes folks who contribute to a 401(k), a 403(b), most 457 plans, and the federal government’s Thrift Savings Plan.1

- For those who are nearing retirement and need to catch up, you can also put an extra $7,500 into your plan if you’re age 50 and older.2

What about the annual limit for IRAs? Now you can save up to $6,500 in your IRA accounts this year—and that goes for Roth and traditional IRAs. If you’re age 50 or older, the catch-up contribution limit will also remain at $1,000, so you can put up to $7,500 into an IRA in 2023 if you’ve fallen behind on your retirement savings.3

One last thing before we move on: You’ll be able to save just a little bit more in your Health Savings Account (HSA) if you have one. For 2023, individuals can save up to $3,850 (that’s a $200 increase), while families can put $7,750 (a $450 increase from last year) into their HSAs.4 It’s a nice bump, so take advantage if you can!

What Are Economic Indicators?

Economic indicators are just some statistics and trends that give us insight into how the economy is doing and where it might be headed. That’s the short and sweet of it. Think of these economic indicators as thermometers that help us keep an eye on the temperature of the overall economy.

Here are six of the major economic indicators to keep an eye on in 2023:

- Stock Market

- Housing Market

- Interest Rates and Inflation

- Unemployment Rate

- Consumer Confidence

- Gross Domestic Product

Let’s take a look at these indicators and find out what they could mean for you and your money.

1. Stock Market

The stock market is kind of like your local supermarket—the biggest difference is instead of buying bread and milk, you’re buying and selling stocks, which are basically small pieces of ownership in a company.

The S&P 500 index, which measures the performance of the 500 largest, most stable companies in the New York Stock Exchange, is considered the most accurate measure of the stock market as a whole. When this index increases, the economy is usually doing well. Still with us?

Market chaos, inflation, your future—work with a pro to navigate this stuff.

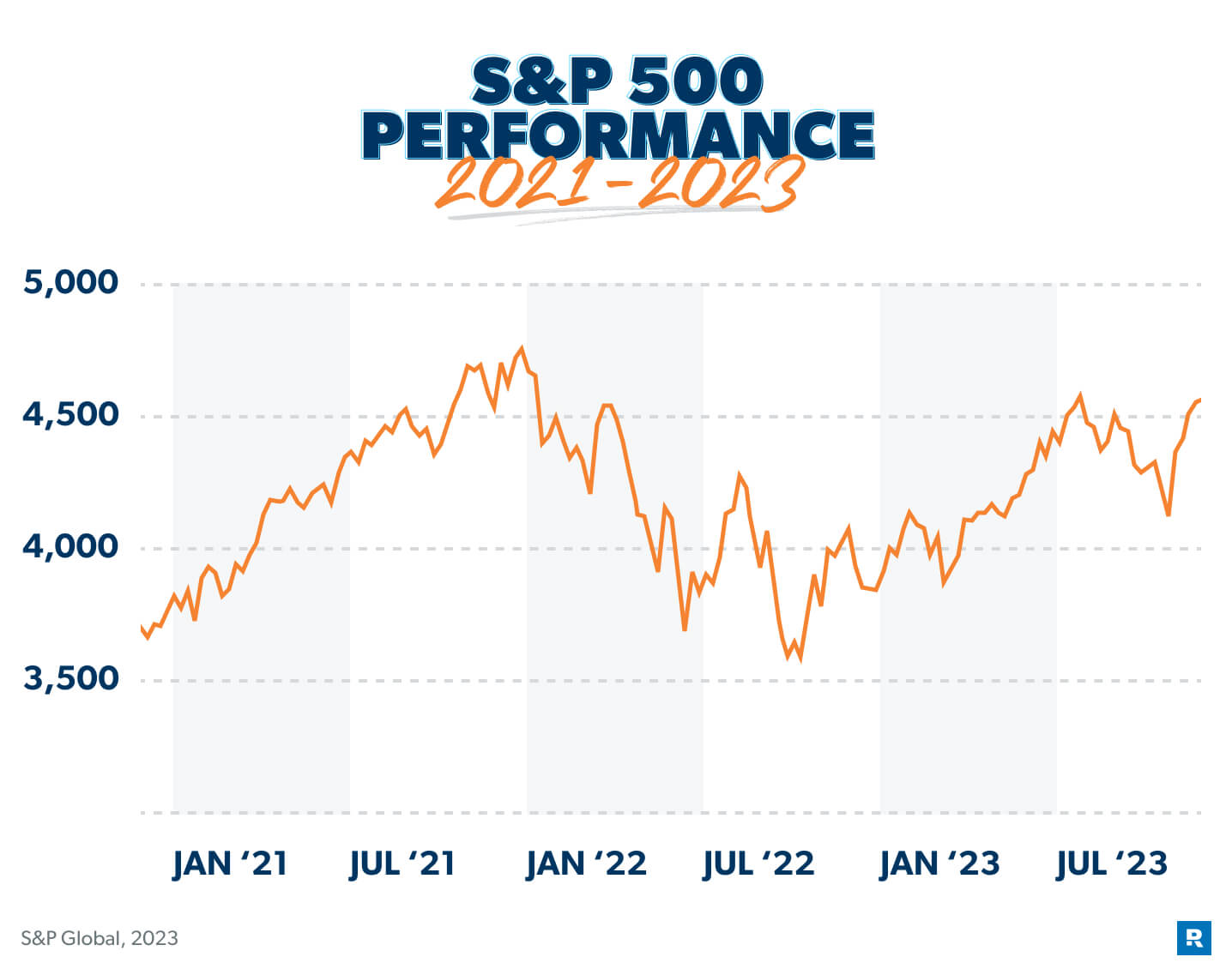

You know we're always telling people that the stock market is like a roller coaster—full of ups and downs that can make your head spin. Well, after the stock market climbed to new heights during 2021, the ride took a downward turn in 2022. Let’s take a quick look back at what happened—and what we can expect moving forward.

Rising inflation and the Federal Reserve’s attempts to combat that inflation with aggressive interest rate hikes made it a rough year for investors. Once all the smoke cleared, the S&P 500 finished 2022 down almost 20%.5 Ouch.

Will the stock market bounce back in 2023? Maybe, but it might be a bumpy ride on the road to recovery.

Analysts from J.P. Morgan and Goldman Sachs are predicting potential stock market losses in the short term. That’s the bad news. But the good news is, the Fed might loosen things up toward the end of the year, which could help the stock market rebound. Ultimately, experts are predicting flat returns (aka stocks not going up or down much) and little to no growth for the S&P 500 by the end of 2023.6,7

But remember: Investing is a marathon, not a sprint. No matter what the stock market is doing, stay focused on the long term, avoid making decisions out of fear, and keep saving for retirement (as long as you’re out of debt and have an emergency fund in place).

Political parties and presidents may rise and fall, but the stock market has a long history of moving upward. The historical average annual rate of return for the stock market according to the S&P 500 is 10–12%.8 So, stay focused and keep putting money in your 401(k) and your Roth IRA—and do not cash them out “just in case.”

2. Housing Market

So, now that we’ve taken a look at what’s happening with the stock market, what’s in store for the housing market? It’s been pretty crazy in 2022, with rising interest rates softening demand and lots of chatter about “crashes” and “corrections.” But what’s really happening in the world of real estate?

Here are a few trends you should be aware of as we move into a new year:

Home inventory is still low but starting to rise.

The real estate market has been dealing with low inventory for several years now, which means there weren’t enough homes for sale to meet buyer demand.

But the tide may be turning in favor of buyers in 2023. Inventory has been increasing since May 2022, which means more homes are on the market for hopeful homebuyers.9

Still, the number of active home listings in late 2022 was about 38% lower than it was before the coronavirus pandemic began.10 So, if you’re planning to buy a home this year, you’ll still have to be pretty quick on the draw!

Home prices are still going up but at a slower rate.

Yes, home prices are still on the rise. The national median home price for active listings was $415,750 in November 2022—that’s an 11% bump from a year earlier.11 But the speed of home price growth is slowing down, which means 2023 will probably be a relatively slow growth year.12

Since there’s still strong buyer demand and a shortage of homes for sale, prices aren’t going to plummet. They’re dipping a bit from month to month (which is a usual seasonal trend for prices after peaking in early summer)—but they’ll still be higher than they were at the start of 2022.

Mortgage rates will likely stay high for now.

The days of record-low mortgage interest rates are over. Because the Federal Reserve increased interest rates in 2022 (more on what might be coming later), the average rate for a 15-year fixed-rate mortgage jumped from 2.66% in January to 6.15% in October—the highest it’s been in nearly 15 years.13 Meanwhile, the average rate for a 30-year fixed-rate mortgage reached 6.9% in October.14

So whether you’re buying a home or selling one in 2023, it might be time to take a good, long look in the mirror and reset your expectations. For sellers, the sudden rise in interest rates have cooled demand . . . which means you may have to be a little bit flexible on your selling price.

What if you’re planning to buy? Our advice is simple: Be patient. If you have to take out a mortgage, a 15-year mortgage is the only way to go. That’s because it’ll save you tens of thousands of dollars in interest over the course of repaying your loan.

Whether you’re buying or selling a home, get in touch with one of our real estate professionals. They know your housing market like the back of their hand and can help you buy or sell your home—even in a crazy housing market!

3. Interest Rates and Inflation

Okay, hang with us here. The Federal Reserve (aka the Fed) is the U.S. central bank in charge of the nation’s policies on money. The Fed has two main goals: grow the economy at a sustainable rate and keep inflation (rising prices of everything from gas to milk) under control.

The Fed has several ways to achieve its goals, but one of its main tools is raising and lowering interest rates. Lowering interest rates can give the economy a boost because it makes people and businesses more likely to borrow and spend money. But if too many dollars are chasing too few goods, prices rise—and that’s called inflation.

Raising interest rates can slow inflation down because it encourages people to spend less and save more. But if rates are too high, they can choke economic growth. When interest rates are high, businesses tend to spend less, and this can also lead to higher unemployment. So, the Fed tries to find a balance that’s just right.

With out-of-control inflation hitting a 40-year high in 2022—impacting everything from how much we spend for a gallon of gas at the pump to the cost of a dozen eggs at the grocery store—the Fed repeatedly raised interest rates throughout the year to try to cool things down. The benchmark interest rate stands between 4.25% and 4.5% heading into 2023, the highest level in 15 years.15

Inflation is starting to show some signs of cooling, but it still remains at well-above-normal levels. So don’t expect the Fed to change course any time soon. Officials say they expect to keep rates high throughout all of next year with no reductions until 2024 at the earliest.16

According to a study done by Ramsey Solutions, Americans say inflation and the cost of living are the two biggest financial challenges they face today. So here are some smart ways to deal with it:

- Stay calm. Don’t panic-buy a bunch of food, gas and other stuff (like toilet paper).

- Adjust your budget for higher prices. This means you might have to cut back on some things in order to pay for necessities. Look for ways to save money by using coupons, buying generic brands, or carpooling.

- Keep investing for retirement. The best way to protect your nest egg from rising prices is to grow your money at a higher rate than inflation with good growth stock mutual funds.

No matter how high or how low interest rates are, borrowing money for things like a car loan or a home equity loan is always a bad idea. We want interest to work for you, not against you. Debt isn’t your friend. It takes your time and money, and it gives you headaches and heartaches in return.

4. Unemployment Rate

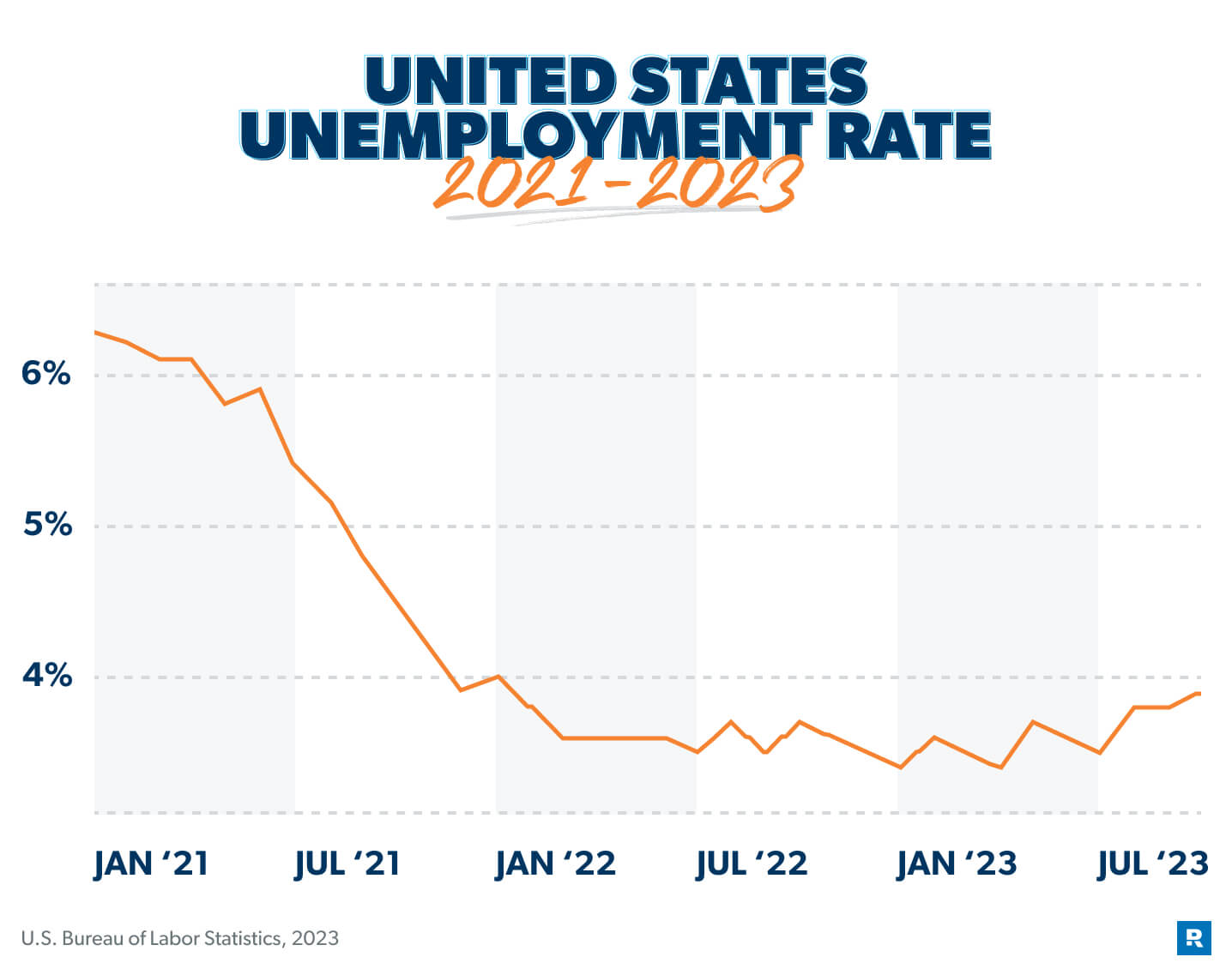

This next one is easy. Each month, the unemployment rate tells us how many people got (or lost) a job. It’s one of the clearest ways to see which way the economy is moving. Rising unemployment is scary—that means fewer people are working, which weakens the economy. Lower unemployment means more people are finding work and the economy is getting stronger . . . which is what we all want.

The unemployment rate at the beginning of 2022 was around 4% (that represents about 6.8 million people), which showed that the job market had pretty much recovered from the pandemic (before the pandemic, the unemployment rate was 3.5%).17

Unemployment remained low throughout 2022 and ended the year around 3.7%.18 This isn’t surprising considering there were times during the year when there were twice as many job openings as workers to fill them.

But toward the end of the year, we saw signs that the red-hot job market was starting to cool off. Many large companies had hiring freezes while others announced mass layoffs just before the holidays.19,20

With the economy expected to slow down even more in 2023 in response to the Federal Reserve’s interest rate hikes, some analysts believe we could see unemployment start to rise in the new year. But even with that pessimistic outlook, the unemployment rate is only projected to rise to somewhere between 4–5% in 2023, which is still fairly low.21,22

So, what does all that mean for your investments? Well, as job growth slows down, that means less growth for companies . . . which could hurt your investments in the short term. But don’t panic—this kind of thing happens from time to time. Work with your financial advisor to see if you need to make any adjustments to your portfolio or if you should just ride it out for the long haul.

5. Consumer Confidence

You can usually tell when someone feels confident. They walk with their head held high, they puff out their chest, and they have a swagger in their step. They also tend to spend more and save less! Well, that last part is what the Consumer Confidence Index says, at least.

The Consumer Confidence Index is a survey done by an organization called The Conference Board. The index measures how everyday Americans feel about the economy. When people are confident, they typically spend more money. When their confidence is low, they don’t.

High inflation, rising interest rates and anxiety over a possible recession on the horizon have put a damper on consumer confidence in 2022, and that’s expected to continue in 2023.23 In the face of rising prices, many Americans are turning to credit cards and buy now, pay later plans or dipping into their savings accounts to keep up their spending.24

With more Americans going back into debt and savings rates slipping to their lowest level in nearly two decades, millions of families could be in trouble down the road. That’s why it’s more important than ever to get on a budget, stay away from debt, and keep saving and investing for the future to outpace inflation.

6. Gross Domestic Product

In a nutshell, gross domestic product (GDP) is the value of all goods and services produced in a country during a specific time period. The GDP of the United States is a huge number: about $20 trillion a year!25 GDP growth is a key measure of the health of a country’s economy.

After the U.S. economy roared back from its pandemic lows in 2021, GDP growth shrunk in 2022 and is expected to finish the year at 1.9%. Some experts predict growth will slow all the way down to zero in 2023, which is lower than the normal rate of 2–3%. They also say a mild recession might be on the way.26

Here’s the Bottom Line

The key to building wealth is consistency. That’s the thread that ties millionaires together.

No matter what’s going on in the world, millionaires keep working hard and putting money away. They don’t get distracted. They don’t put their hard-earned money in a flashy investing trend they don’t fully understand. They don’t panic every time the stock market has a bad day.

And one day, they look up and see their nest egg has hit the seven-figure mark. Now that’s what winning looks like. And there’s no reason that can’t be you someday.

Dave Ramsey's new book, Baby Steps Millionaires, will show you the proven path that millions of Americans have taken to become millionaires—and how you can become one too! Order your copy today and learn how to bust through the barriers preventing you from becoming a millionaire.

Need More Investment Advice? Find a Pro!

While some of the current trends can be concerning (inflation, rising interest rates), it’s not all bad news (strong job market, stable housing market). But we’re guessing you probably have more questions about your own situation.

While we can’t speak into the specifics of your financial plan, the good news is, you can sit down with an investment professional in your area who can.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.