Over half of your employees worry about their personal finances daily. That’s a whole lot of stressed-out employees, which creates a huge opportunity for employers like you to give them some relief.

And that’s where financial wellness benefits come into play.

Financial wellness benefits help your employees where they’re hurting the most—their wallets. If you can help your employees manage their finances, you’ll notice improved engagement, retention and productivity in your company.

That’s why we’re digging into the facts—so you can see just how much a financial wellness benefit can help your company.

What Is a Financial Wellness Benefit?

Most financial wellness benefits teach employees how to budget, manage debt, and save for the future. And SmartDollar does this too, but with a few important differences.

SmartDollar helps employees take control of their money so it doesn’t take control of them. And taking control of your money looks like a having zero-based budget, so you know where every single dollar you make is going every month. It means eliminating debt, not managing it. Debt creates stress, and stress sucks. And saving for the future is part of building wealth through income, wise investments and home ownership.

Clearly, there’s a lot included in a good financial wellness benefit. And your employees are asking for it! Employees are sick and tired of struggling financially. Life is expensive, so they need their income to work harder for them. And to meet the increased cost of living, employers are looking at financial wellness programs as an important addition to their employee benefits package.

Unfortunately, you’ve probably come across some pretty bad options while looking for financial wellness solutions, like:

- Financial stress management

- Home equity loans (and other types of debt)

- Credit cards

- Debt consolidation

- High-risk investments (like crypto)

- Social media financial trends

These methods don’t bring real financial wellness. They only help your employees manage debt. True financial wellness comes from eliminating financial stress and debt and making smart investments that your employees fully understand—not half-baked ideas that don’t make sense.

Why Is It Important to Offer Employees a Financial Wellness Benefit?

Every day your employees struggle with their personal finances is another day they’re distracted during meetings or checking their bank accounts instead of their emails.

The success of your company depends on the well-being of your employees. Check out these stats from The 2022 SmartDollar Employee Benefits Study:

- 36% of employees missed work due to a financial problem in their personal lives

- 56% of employees feel like they can’t get ahead with their personal finances

- 56% of employees experienced burnout at work in the last month

- 51% of employees said money stress has negatively affected their mental health

Bottom line: Your employees can’t improve their finances on their own. They need your help. Without a financial wellness benefit, they’ll continue to struggle—and so will your business.

What Kind of Financial Wellness Benefits Do My Employees Want?

Helping your employees with their money might sound like a roundabout way of saying you should give your employees a raise—but that’s not the only way to help. Sure, that might be the answer for some employees, but if you’re paying the market average or above, more money doesn’t always help. Behavior change, on the other hand, always helps.

And a good financial wellness benefit can help change your employees’ money behavior. Most employees want help managing their finances. A whopping 73% of those surveyed in The 2022 SmartDollar Employee Benefits Study said they wish their employer offered more financial wellness resources. But only 23% of employees actually have access to a financial wellness benefit from their employer.

Click here for free, SHRM-accredited webinar content on all things HR and business leadership.

Giving employees access to a financial wellness benefit is an easy route to happier, healthier employees and a happier, healthier business. A well-designed financial wellness benefit addresses your employees' greatest needs: retirement, emergency savings, debt elimination and budgeting. Let’s talk about what this looks like.

1. Retirement

Any financial wellness benefit worth its salt coaches employees in retirement savings. You want your employees to retire at an appropriate age so younger generations can fill their spots or you risk higher turnover because of fewer growth opportunities. If more employees participate in your sponsored retirement savings plan, they’ll be happier and more productive at work because they’ll see the light at the end of the tunnel.

2. Emergency Savings

Did you know 45% of employees are distracted by their financial struggles while at work? An emergency savings fund helps reduce financial stress because your employees are prepared for anything life throws at them. They can focus on work and let their emergency fund take care of the rest.

3. Debt Elimination

Student loan debt is in crisis mode to the tune of $1.6 trillion! And credit card debt isn’t far behind at $986 billion.1 All in all, the average American household is in $101,915 of debt (including home mortgage).2 Yikes! Debt is robbing your employees of their financial security.

Instead of saving money for emergencies and retirement, they’re filling the fat pockets of credit lenders and banks. The best financial wellness benefits offer coaching and financial guidance to help your employees pay off debt and stay out of debt. For good.

4. Budgeting

Budgeting is the foundation of all great financial wellness benefits. A budget shows your employees how they’re spending their money. Without a budget, your employees can’t save for retirement, pay off debt, and build an emergency fund. Why? Because they don't know where all their money is going. A budget is the compass to their finances.

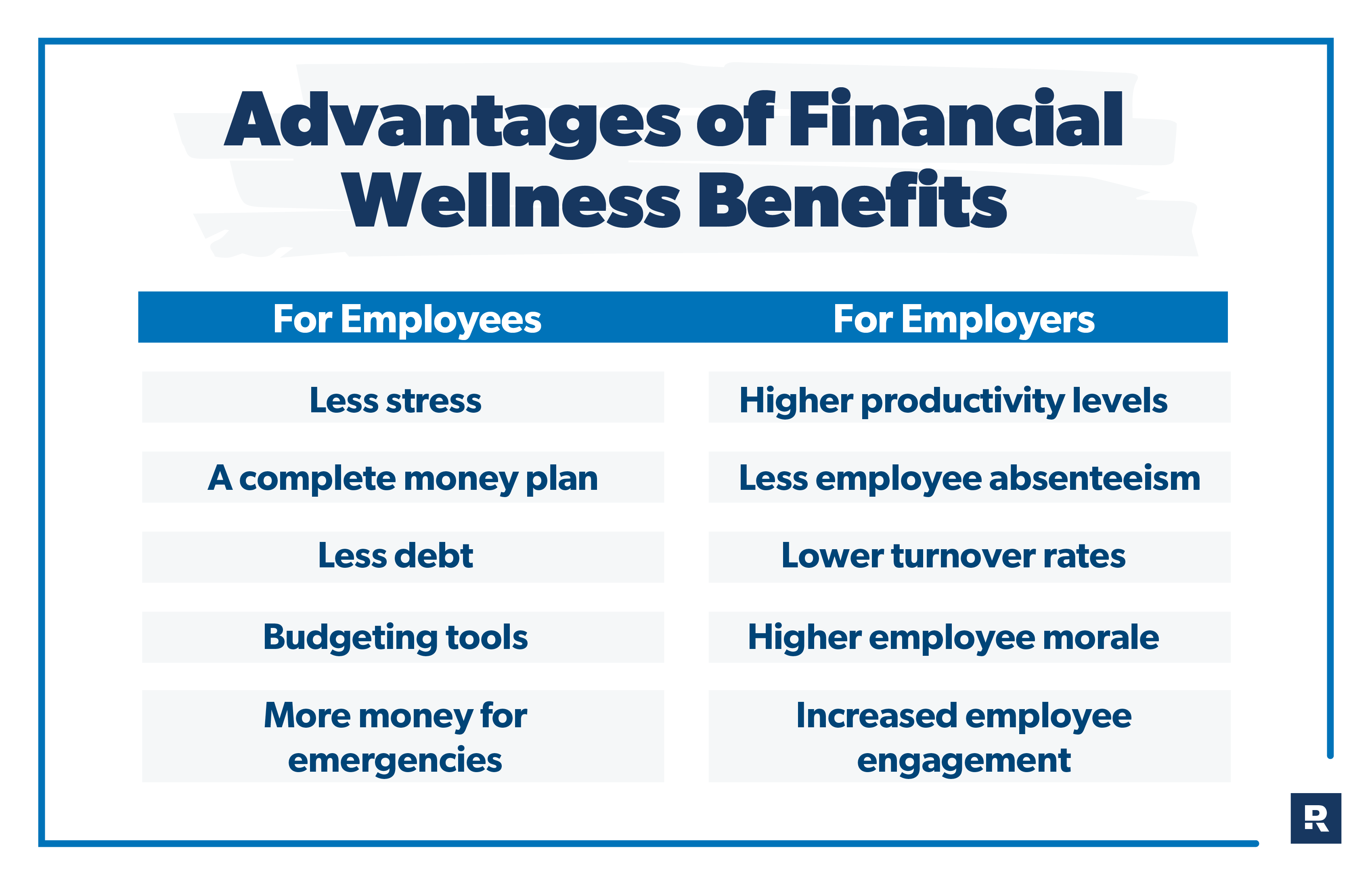

Advantages of Financial Wellness Benefits for Employees

Here’s the thing about a financial wellness benefit—it does more than just help with money. When your employees have healthy money habits, it affects their overall well-being. Here are five ways a financial wellness benefit can help your employees:

1. Less Stress

Do you know how many of your employees are struggling financially? The 2022 SmartDollar Employee Benefits Study shows that 55% of employees worry about their finances every single day. Personal finance problems don’t stay personal—they follow your employees to work. And financial stress is hurting your team’s ability to work effectively. Paycheck planning and budgeting reduce financial stress. And with a financial wellness program like SmartDollar, employees get all this and more so they can figure out what the heck they’re doing every month with their income.

2. More Money for Emergencies

You know Murphy’s Law—anything that can go wrong will go wrong. And that’s how life goes sometimes. But an emergency fund protects you when your kid gets sick, you get in a fender bender, or your dog decides to eat chocolate. Instead of scrambling for money when something like this happens, your employees can cover unexpected events with the money they’ve saved in their emergency fund.

3. Less Debt

A financial wellness program can help employees get out of debt. Debt-free folks have a lot less money stress. Think about the last time you owed someone money. You probably had a pretty miserable existence until you paid them back. You had this knot in your stomach that would expand every time you saw the person. The same goes for your employees. When they’re battling debt up to their eyeballs, it eats up all their energy. Debt-free employees are happier and healthier.

4. Budgeting Tools

Budgeting is all about telling your money where to go and controlling how you want to spend it. And a budget helps employees make sure they’re spending their money the right way. Once your employees know how much money they’re bringing in, they can make smart decisions about how to spend it. And a budget helps them see these numbers super clearly.

5. A Complete Money Plan

We ask our money to do a lot for us—from budgeting and saving for college to investing and saving for vacations. It’s pretty intimidating trying to keep track of it all. Employees can fight the intimidation with a step-by-step plan that walks them through each financial phase when they have a financial wellness benefit with a complete money plan.

How Will a Financial Wellness Benefit Help My Business?

We’ve spent a lot of time talking about how a financial wellness benefit helps your employees, but they’re not the only ones—financial wellness benefits also take care of your business.

Businesses succeed when their employees succeed. Here are some of the benefits your business will experience when your employees are financially secure:.

1. Higher Productivity Levels

The American workforce is facing the steepest decline in employee productivity since 1948.3 Low productivity is a product of distracted employees. But a financial wellness benefit can fix that. Eight out of 10 employers said they’ve seen financial health improvements in their employees after offering a financial wellness benefit like SmartDollar.

2. Increased Employee Engagement

What do weddings, babies and college tuition have in common? They all cost money. A lot of it. Employees who feel financially secure and prepared for these types of life events won’t be as distracted at work. And they’ll bring their money momentum to work with them and grow the company culture.

3. Higher Employee Morale

Saving money? Check. Paying off debt? Check. Saving for retirement? Check. Happy to come to work? Check, check, check! Employees who use a financial wellness benefit are twice as likely to say their personal finances are better off after one year than those who don’t use a plan. So, in one year’s time, your employees can go from stressed out and scared to confident and excited about their financial futures—which means they’ll also have higher morale at work.

4. Lower Turnover Rates

It’s more expensive to hire new talent than it is to take care of your employees.4 Instead of dealing with high turnover rates and retention problems, you can actually save money by offering a financial wellness benefit. Plus, if you pair this with steady raises and promotions, your employees are more likely to stick around. Remember: Employees who have financial stability are less likely to jump ship in search of a raise.

5. Less Employee Absenteeism

The anxiety and burnout that comes from grappling with financial stress is wearing out your employees—to the tune of 36% of employees missing work due to a financial problem.

But you can cut down on absenteeism. A financial wellness benefit helps your employees take control of their money and reduce their financial stress. Instead of worrying about your employees and whether or not they’ll show up to work, you’ll see them come in every day with a smile on their face.

Financial Wellness Benefits: An Essential Part of Your Employee Benefits Package

A healthy employee benefits package is always changing. HR leaders are constantly looking for new benefits to share with their employees to keep them around and attract new hires.

A financial wellness benefit gives your employees hope and excitement with their money that they’ve never felt before. It’ll turn your employees’ lives around—and you’ll find them to be more productive and engaged at work.

Your business wins when your employees win. So a financial wellness benefit should be part of your employee benefits package. To learn more about how a financial wellness benefit can help your employees, visit smartdollar.com.